Why Energy Storage ROI Often Falls Short — and It’s Not the Hardware

The Economics of Intelligent Energy Storage, Part 1/8

Battery storage deployment continues to grow across grids, fleets, industrial sites, and microgrids. While investors and operators expect these storage systems to help save costs, create new revenue streams, and boost resiliency, many projects underperform financially.

The real reason why they fall short has nothing to do with battery chemistry or capacity. What must change is the fundamental mindset of treating stored energy as a homogeneous commodity with fixed marginal cost.

Most ROI models overlook that the economic value of stored energy varies with demand urgency, future opportunity costs, and asset conditions. Treating every kilowatt-hour interchangeably ignores the fact that some energy is more valuable than others.

To increase energy storage ROI, we must recognize that the value of stored energy is context-dependent, shaped by asset health, condition risks, and opportunity costs. This series examines how treating storage systems as managed economic assets, rather than static boxes, changes how we measure cost, capture value, and make decisions.

The myth of constant energy cost

Traditional energy planning often treats the cost of a unit of energy (e.g., a kilowatt-hour) as having only one variable: price. Yet, the value of storing or selling it changes dynamically based on factors such as demand fluctuations, market pricing signals, system constraints, transmission line load, battery unit degradation, and forecasted events, among others.

What’s often overlooked is that battery wear is not a fixed cost. Deeper discharge, faster charging, and operating outside ideal conditions all change the real cost of delivering energy. In other words, the price of selling energy should reflect not only market demand but also the workload imposed on the asset.

For example, utility companies charge customers more for power used during peak periods. Likewise, selling stored energy during a grid emergency has a different value than using it for internal load-shifting.

To optimize revenue and total cost of ownership (TCO), operators must understand these shifts and react as close to real-time as possible to reap the most economic benefits.

Visibility unlocks real storage value

Today, most battery storage systems operate under conventional assumptions about performance and cost. With limited visibility into state-of-health (SoH), degradation, and actual operating conditions, operators often fall back on:

Rule-based dispatch (e.g., fixed charge/discharge windows)

Static cost assumptions (e.g., “sell at X price”)

Fixed depreciation models

These static approaches are easy to follow but leave economic value on the table because they fail to account for real-world variability in battery behavior and energy values. They assume the battery’s economic behavior is predictable and uniform. Yet, without understanding how operating decisions affect future value, operators are flying blind on pricing, not just performance.

For example, we typically don’t push batteries to 100% depth of discharge (DoD) to optimize longevity. However, you can make a calculated decision to do so if you have data showing that the benefits of increasing the DoD outweigh the cost of the additional degradation.

Data analytics can give us insights to make informed decisions. However, data collection is just the first step. Can we answer critical questions such as:

What is the true cost of energy at this moment?

What is the battery’s real capacity and health today?

Is it economically better to store, discharge now, or defer?

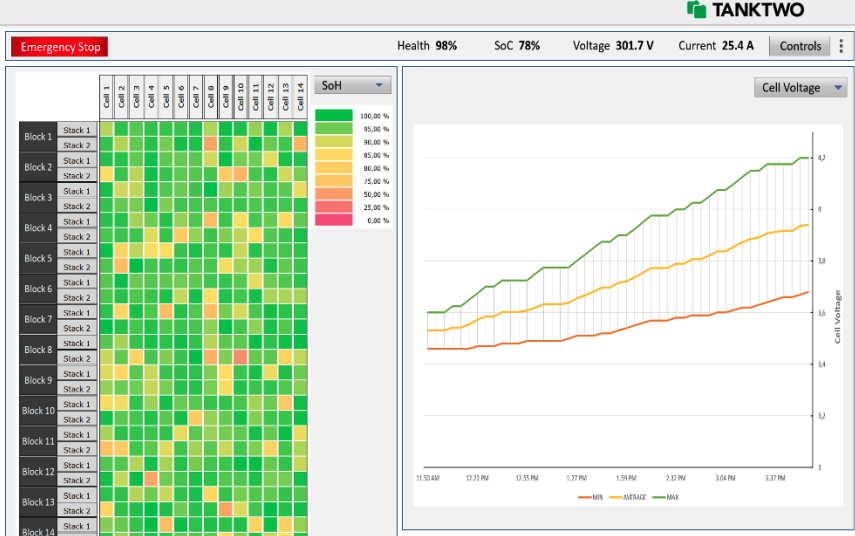

That’s where advanced battery technology comes in. For instance, the AI-driven Tanktwo Battery Operating System (TBOS) illuminates dark data collected through energy storage systems. It helps operators tap into the data’s potential to inform operational and strategic decisions or automate workflows for real-time responses.

Dynamic insights drive dynamic value

To understand how information improves economic outcomes, imagine two battery energy storage systems:

System A uses generic rules and static assumptions.

System B continuously monitors detailed data and adjusts decisions based on evolving cost and demand signals.

While system A doesn’t have the capability to respond to shifting market and operating conditions, system B can adjust its behaviors based on real-time and forecasted energy costs to automate tasks such as:

Charging when the energy value is low.

Charging slowly when there is no rush or more aggressively to prepare for changes.

Limiting state of charge (SoC) and DoD when there is little volatility.

Pushing the batteries harder when a big uptick in energy resale prices is expected.

Applying a stricter temperature window when the goal is to minimize degradation.

Quantifying potential profits to charge more under punishing operating conditions.

Holding energy when future prices are predicted to rise.

Selling stored energy when demand spikes and prices peak.

The key difference is that System B evaluates not just what energy is worth now, but what it might be worth later, and determines prices accordingly.

Such value-based dispatch enables operators to treat each unit of stored energy as a resource whose value changes with conditions. They can extract more revenue per cycle and make impactful decisions on when and how to use the asset.

Battery predictive analytics: The foundation of context-aware storage management

Predictive analytics turns data insights into value to inform dynamic decision-making, helping operators answer questions like:

How will demand and price shift in the next hour?

What is the risk of degradation if we discharge by another 10%?

How will weather, demand forecasts, and market trends affect value?

Answering these questions enables dynamic pricing of stored energy. When operators can quantify the cost of strain, risk, and future scarcity, they can decide when energy should be sold at a premium and when it should be conserved.

For example, in a mobile energy-as-a-service (EaaS) model, real-time synchronization and optimization help make delivery more cost-efficient, unlocking opportunities by providing flexibility unmatched by hardware-focused solutions. Success isn’t about moving more energy. It’s about delivering it when its value density justifies the cost and wear.

Real-time data streams and analytics are already used in various industries to support dynamic pricing, risk management, and asset utilization — so why not in energy storage?

An information-centric approach for pricing professionals and business modelers

To improve storage economics, operators must evolve from static, simplistic cost assumptions and fixed rules to an information-centric approach. Each decision should reflect current and forecasted value, recognizing that energy value is dynamic — varying with demand, asset wear, market conditions, system constraints, and opportunity costs.

Operational decisions, but even more so pricing decisions, should be based as much as possible on quantifiable factors, accurate models, and current, relevant information.

Business operators require access to granular and accurate data on battery condition, performance, and external drivers (e.g., price and demand patterns) to establish visibility into dynamic cost and performance. Moreover, they need the ability to not only analyze the information but also to synthesize the insights to drive real-time, automated responses.

TBOS goes beyond collecting and analyzing data about an energy storage system. It provides the capability to track the SoH of individual cells, connect the dots with external drivers, and automatically adjust battery behaviors based on complex, customized parameters. It provides decision-makers with clear insights to make agile, accurate, and profitable decisions.

In upcoming posts in this series, we’ll explore how to reduce uncertainty to achieve measurable economic impact, how to leverage predictive degradation and intelligent dispatch in energy storage, and how to unlock new value by treating batteries as managed assets rather than considering energy as a homogenous commodity.