The Brave New World of the Global Battery Economy: What Investors Need To Know

Morgan Stanley’s 110-page research report “The New Oil: Investment Implications of the Global Battery Economy” projects that the global battery economy will exceed $500 billion by 2040.

Between 2019 and 2021, investments in the battery economy increased by as much as 20x as technology, climate-oriented stimulus policies, and ~$2 trillion of capital converged. We saw 5 if not 10, years' worth of progress in 2 years.

We have reached the tipping point where electrification is a fact of life.

A pivotal moment in the battery economy

The increase in battery efficiency is like compound interest — just a few percent of improvement builds upon itself over time to create an exponential leap in progress.

Meanwhile, the flurry of environmental, social, and governance (ESG) mandates and government climate policies made adopting green technologies and reducing carbon footprints not an option for corporations in every sector.

Maturing battery technologies along with the policy and ESG drivers create an industrial flywheel that accelerates capital formation, lowers costs, and supports implementation at commercial and industrial scales.

We’re now seeing this trend in electric vehicles (EVs) for the consumer market. But that’s just the tip of the iceberg.

The technological advancement, capital injection, infrastructure upgrades, and manufacturing scale will create a virtuous cycle to drive the electrification of everything from industrial autonomy and robotics to defense and more. In fact, Tanktwo has been working with a prominent defense manufacturer for a few years to develop cutting-edge battery solutions.

But there’s a plot twist…

Will everything be fine and dandy if you put your money in a battery manufacturing company that pumps out more cells faster and cheaper?

Not so fast. Existing battery solutions can’t support electrification responsibly and sustainably — this post details the environmental and social impact of the entire lithium battery lifecycle. A wave of massive reset will hit the sector to address electrification's direct and indirect consequences.

Morgan Stanley also predicts that “structural batteries or super-capacitors may carry the future of the global green economy rather than today’s widely used lithium-ion battery. A structural battery can be an airplane wing, car body, or phone case with a thin sheet of woven glass that separates the two electrodes.”

But today’s battery packs are, for all intents and purposes, non-serviceable. A single failed cell often brings down the entire system.

The concept of a structural battery isn’t even theoretically feasible with current technologies — when cells make up the structure of a vehicle or piece of equipment, repair becomes impossible. You’d be scrapping a durable asset just because a few deteriorating wear items (i.e., the cells) fail. So much for sustainability!

Not to mention, you’ll need a technology that can adapt to any form factor without reinventing the wheel every time to achieve the economy of scale. Again, not possible with the current approach to battery pack development.

Additionally, the report warns against obsolescence risks from technological breakthroughs. For example, today’s battery pack solutions are chemistry-specific, and operators can’t mix cells of different compositions — restricting companies’ ability to switch to new (e.g., less costly and more environmentally friendly) chemistries without making essential changes to their designs.

The report also analyzes the many unknowns and variables regarding battery chemistries. But those concerns are based on old assumptions. Tanktwo’s technology, which can use battery cells of any chemical composition (including solid-state batteries mentioned in the report), allows companies to eliminate this big question mark.

Lastly, we must resolve issues related to commoditization, which is inevitable when any technology matures. The scale will create supply chain challenges, and we need a battery solution to help manufacturers and operators mitigate the impact of supply chain fluctuations.

This post unpacks this topic in detail and discusses why a system that can use cells of any battery chemistry is critical to alleviating supply chain crises.

But wait… isn’t commoditization a risk?

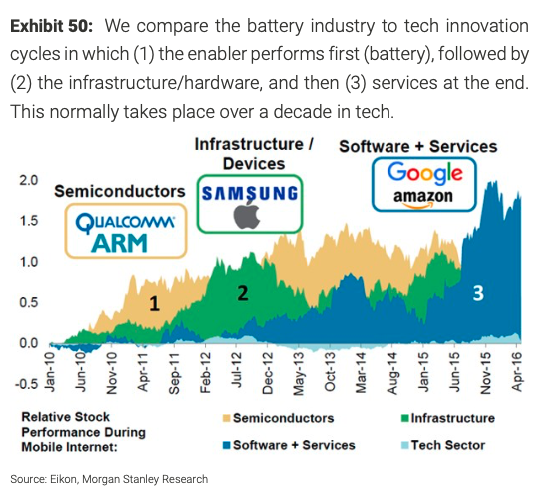

Commoditization is tied to industrialization and deflation. But it won’t become the enemy of profits if we can look beyond hardware to create a new dimension of value — as the PC or smartphone industry does.

For example, out of a $100 value of an Apple device, only $2 to $5 goes to Foxconn in China — even though it handles 99.99% of the parts and labor and 100% of the manufacturing process.

Meanwhile, $95 to $98 of the value (and with this, a profit opportunity) stays within Apple. How? Although the smartphone is a commodity, Apple adds value by providing the operating system (i.e., the software) and the ecosystem to make the hardware deliver a customized experience that can evolve with market demand at the drop of a hat.

All industry giants like Microsoft, Oracle, IBM, Adobe, and Google have always run on this business model. The commoditization of hardware is inevitable. Instead of fighting it, the key to profitability is to continue value creation — 90%+ of these companies’ operating profits come from advancing software solutions and services.

Look beyond the battery pack: The money is in the data + software

Google and Amazon are successful not because they sell Pixel Phones or ship stuffed animals for Valentine’s day.

Google democratized information and content. Airbnb changed the hospitality sector. Uber disrupted the transportation industry. Amazon redefined retail, starting with “you may also like.” Their business models are built on the algorithmic disintermediation of inefficient middlemen.

Software, data, and services are where the profit lies as any technology matures. Tanktwo Battery Operating System (TBOS) will have the same catalytic effect on anything that runs on electricity.

how confident are you about the $500+ billion market?

The Morgan Stanley report offered three projections for the total addressable market (TAM) size by 2040: ~$260B for the bear case, ~$525B for the base case, and ~705B for the bull case.

The upside for a software- and algorithmic-driven model is that there’s no bad scenario because it’s substantially more scalable and flexible than a hardware-focused one. Even with a $260B TAM, the opportunity is so vast that taking just 0.1% of the market will be more than enough for any company to thrive.

Tanktwo and the software-defined, data-driven TBOS position us at the final phase of the evolution of battery technology, where software and services are the keys to profitability. More importantly, our 28 patents encompass technologies that will allow us to address the various concerns and predictions mentioned in the Morgan Stanley report:

Our technology is vertical-agnostic. Any high-value equipment that runs on electricity can benefit from our data-driven approach to battery management.

Our solution alleviates electrification’s pressure on the environment by increasing operational efficiency and maximizing the lifespan of each cell.

Our modular battery solution can take on any shape and form to make structural batteries a reality.

Our battery systems can use cells of any chemistry, eliminating obsolescence risks related to the introduction of new (more environmentally friendly) cell compositions.

Our technology can minimize supply chain fluctuations to make the commoditization of batteries possible so businesses can focus on value creation.

Like the MS-DOS and Windows operating systems laid the foundation for personal computing to thrive in businesses, TBOS will become the backbone for the electrification ecosystem — pushing the global battery economy to its logical conclusion: Providing a platform for software and services to create value.

If you’re interested in a closer read of “The New Oil: Investment Implications of the Global Battery Economy” report and exploring an investment opportunity in the $500B TAM, get in touch to see how TBOS can position you at the pivotal moment of electrification history.